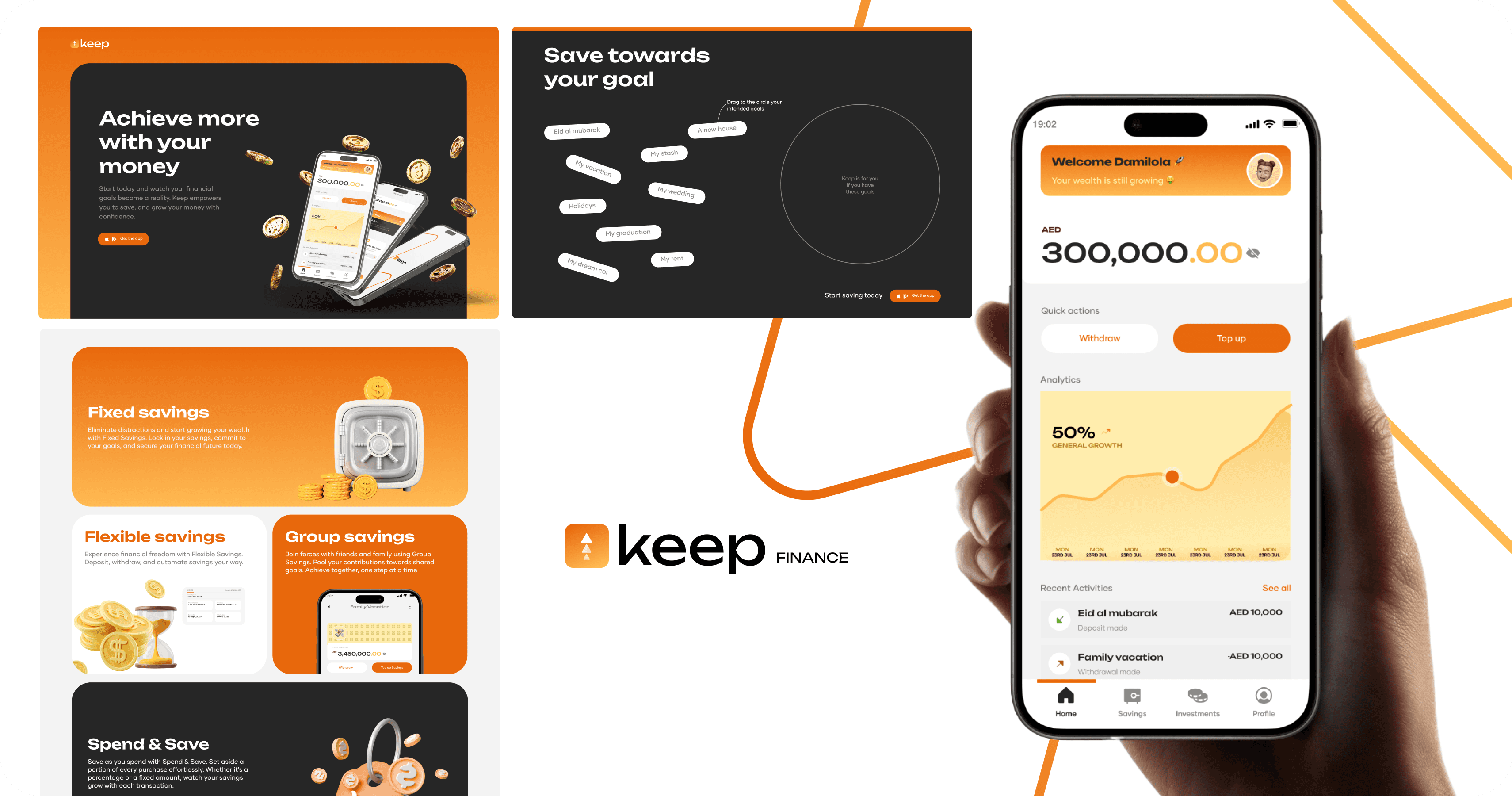

Keep finance

Empowering users in the Gulf region with flexible savings options and innovative features like "Save as you spend" and group savings

Finance

Mobile app

Website

My Role

Product designer — Visual Design, User Flows, Rapid Prototyping

Client

Keep Finance

Timeline

1 month

Overview

Worked with a team of amazing designers on this project, I played a key role in designing Keep Finance, a fintech app aimed at helping users in Dubai and the surrounding region achieve their financial goals.

The app features innovative solutions like "Save as you spend" and group savings, promoting a community-driven savings culture.

My contributions focused on creating a user-friendly website and interface that seamlessly integrates fixed and flexible savings options, enabling users to develop consistent saving habits.

The problem

As financial goals in the GCC evolved, Keep Finance needed to offer efficient, accessible savings solutions—without the usual complexities.

Financial management is often too complex; a simplified solution is needed.

There's a demand for tools that support group savings and community goals.

It’s challenging to maintain consistent saving habits without automated features.

Users in the GCC struggle to find intuitive, user-friendly savings platforms.

The solution

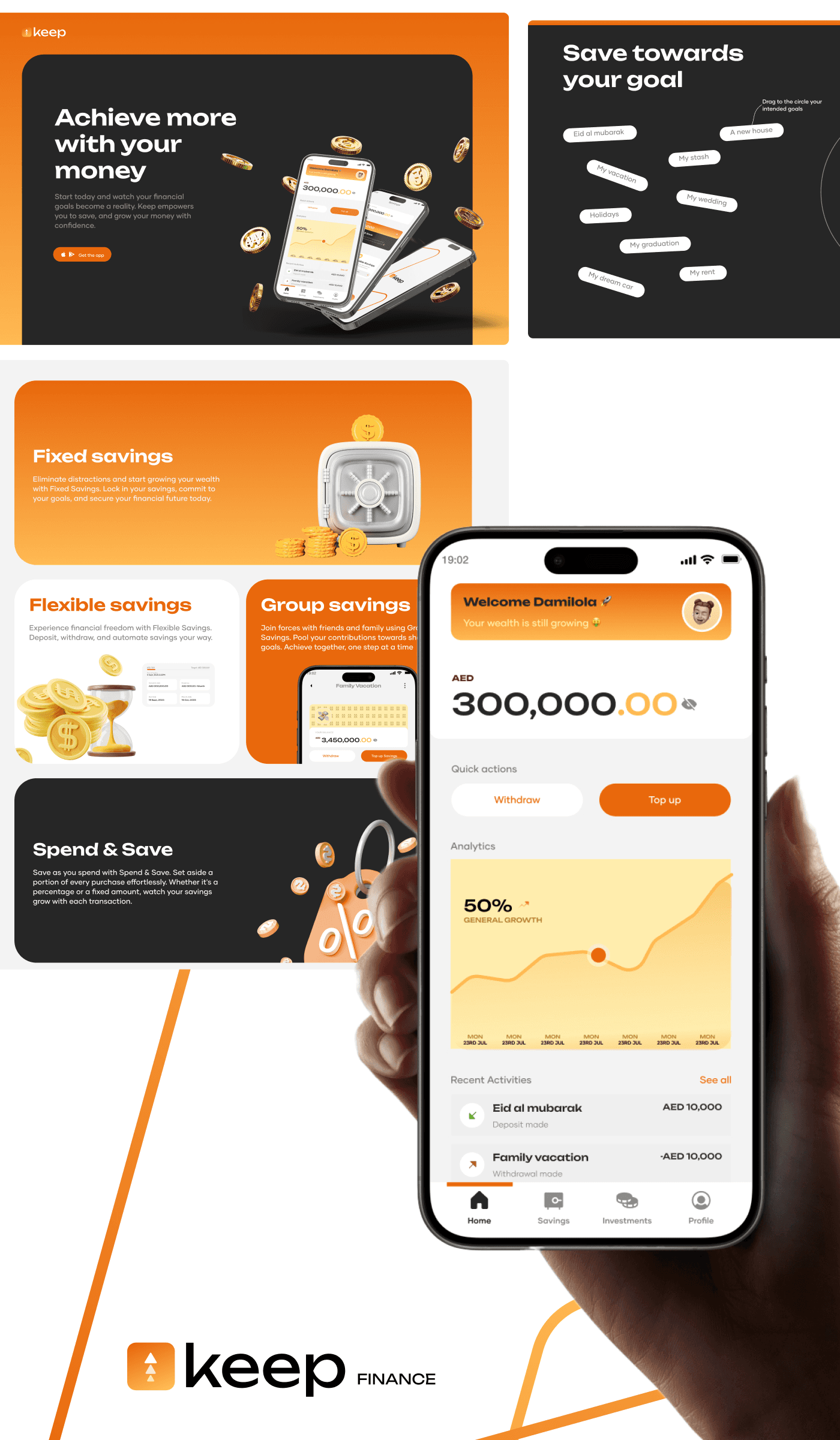

To tackle the issue of "Savings are slipping away," we researched why users struggled to save consistently.

We designed a platform with intuitive features like "Save as you spend" and flexible savings options. Through user feedback and iteration, we created a product that simplifies saving and helps users stay on track with their financial goals.

It was not linear

Our design process was iterative, driven by user feedback and A/B testing. Initial feedback revealed pain points that led us to refine both web and mobile experiences.

By making data-driven adjustments and addressing edge cases, we developed a platform that effectively meets user needs and supports their financial goals.

The result

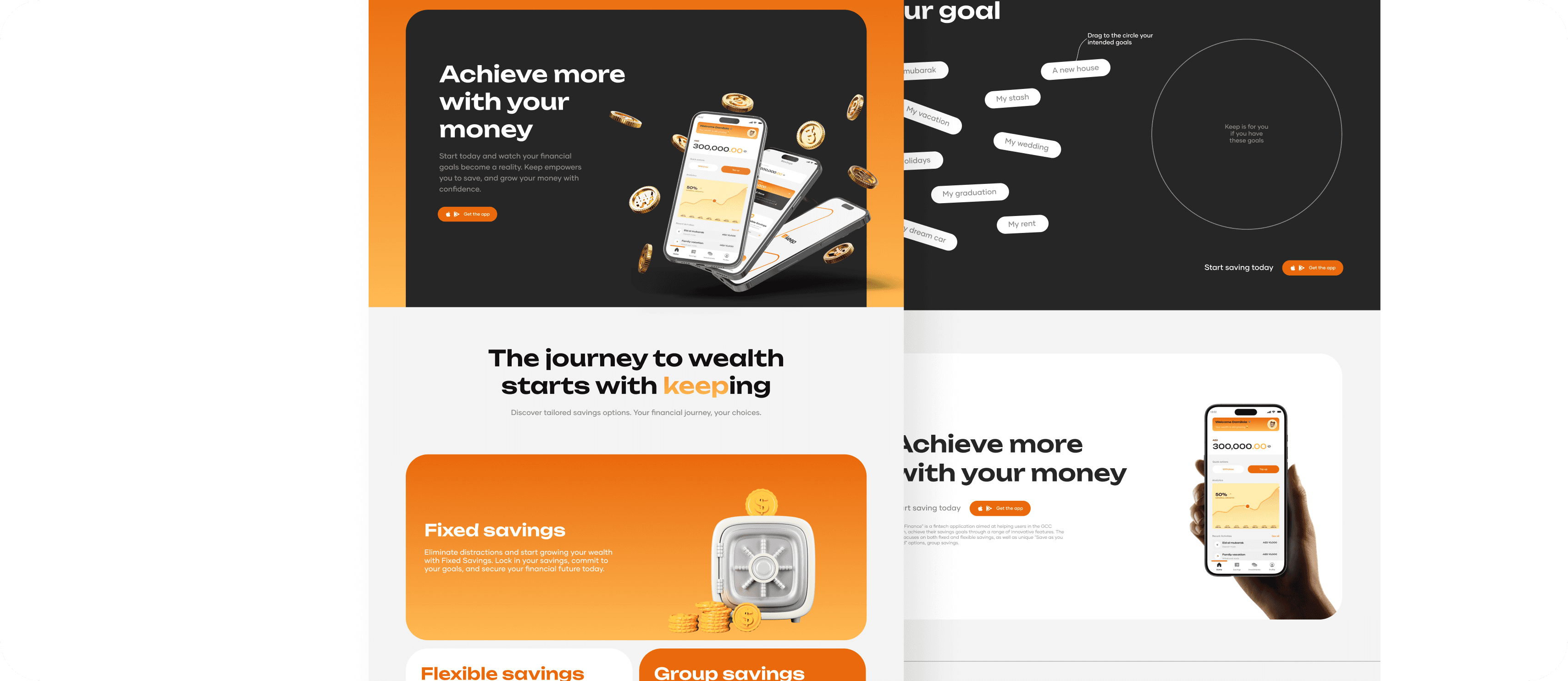

Our launch of the Keep Finance platform has resulted in outstanding outcomes that demonstrate its effectiveness:

30% Increase in User Engagement: The intuitive design encourages users to explore the app’s features and tools actively.

40% Growth in Group Savings Participation: The introduction of community-driven features has fostered a collaborative savings culture among users.

Improved Saving Consistency: Users reported a 25% increase in consistent saving habits, thanks to automated features like "Save as you spend."

High User Satisfaction Ratings: Feedback indicates that users appreciate the accessibility and simplicity of the app, leading to positive reviews and recommendations.